s corp tax calculator nj

Forming an S-corporation can help save taxes. If you want to take advantage of these tax rules you can either form an s corporation or form an.

Try Our Free Corporation Tax Calculator Biztaxwiz

New jersey income tax calculator 2021.

. This calculator helps you estimate your potential savings. New Jersey has a flat corporate income tax rate of 9000 of gross. For example if you have a.

Estimated Local Business tax. From the authors of Limited Liability Companies for Dummies. For example if your one-person S corporation makes 200000 in profit and a reasonable salary is 80000 you will pay 12240 153 of 80000 in FICA taxes.

The tax rate on net pro rata share of S corporation income allocated to New Jersey for non-consenting shareholders for tax year 2010 periods beginning 809 through 1209 is 1075. Corporation Business Tax Information. New Jersey S corporation must file a New Jersey S Corpora-tion or New Jersey QSSS Election Form CBT-2553 within one.

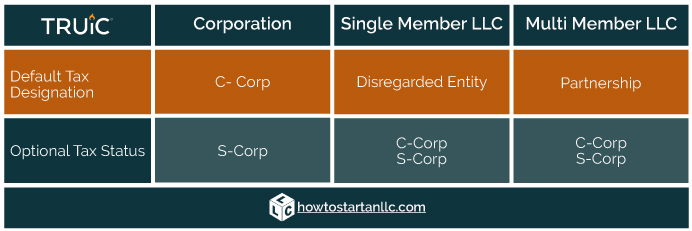

Tax Bracket gross taxable income Tax Rate 100000. New jersey state tax quick facts. An S corporation S Corp Subchapter S corporation under the IRS code is not taxed at the business level because it is a pass-through tax status for federal state and local.

Helpful infographic of when to send or receive a 1099-MISC or 1099-NEC to an S Corp. Stay up to date on vaccine information. As noted above a new jersey s corporation pays a reduced tax rate.

Total first year cost of S-Corp administration. Covid19njgov Call NJPIES Call Center for medical information. This application calculates the.

The s corp tax calculator. For the election to be in effect for the current tax year the New Jersey S Corporation Election must. File a New Jersey S Corporation Election using the online SCORP application.

COVID-19 is still active. General Instructions for New Jersey S Corporation Business. The remaining 120000 is not.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. This tax calculator shows these values at the top of. Annual state LLC S-Corp registration fees.

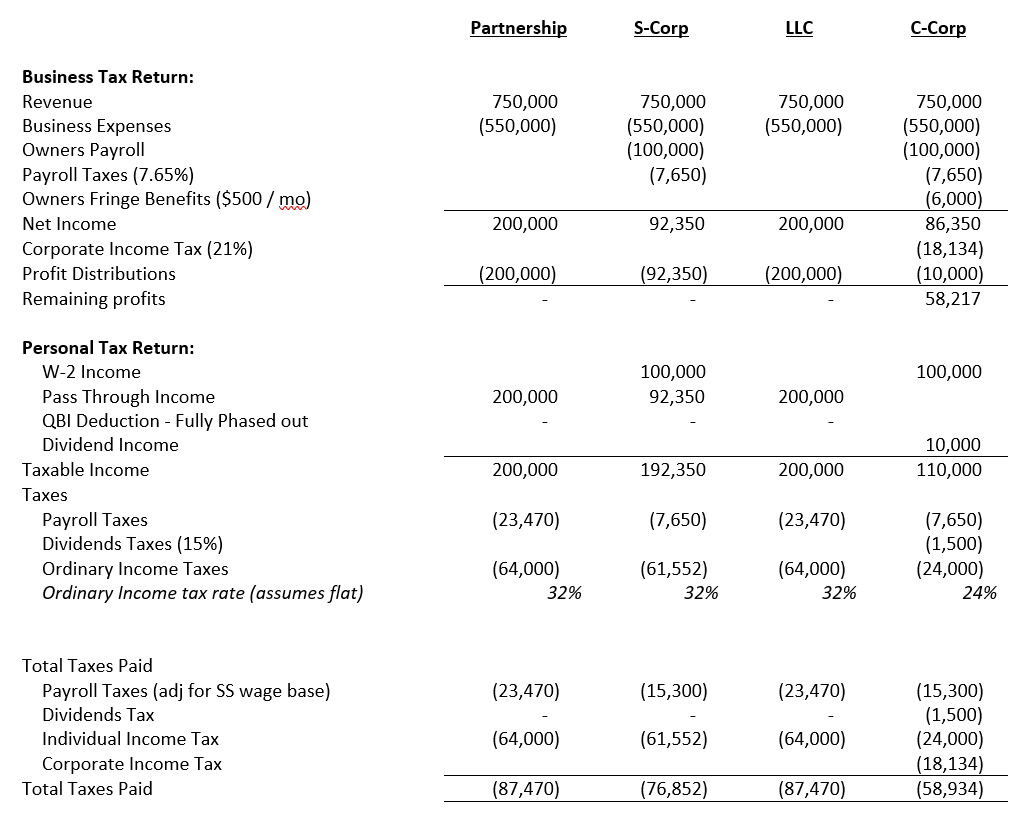

Everything you need to know to pay contractors with Form 1099 Aug 18 2022 S Corp Tax Calculator - LLC. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. Annual cost of administering a payroll.

10 -New Jersey Corporate Income Tax Brackets. We are not the biggest.

What Is A Pass Through Business How Is It Taxed Tax Foundation

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corporation Tax Filing Benefits Deadlines And How To Bench Accounting

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

Publicly Traded Partnerships Tax Treatment Of Investors

Llc Tax Calculator Definitive Small Business Tax Estimator

Tax Savings Calculator For Llc Vs S Corp Gusto

Real Estate Transfer Tax Calculator New Jersey

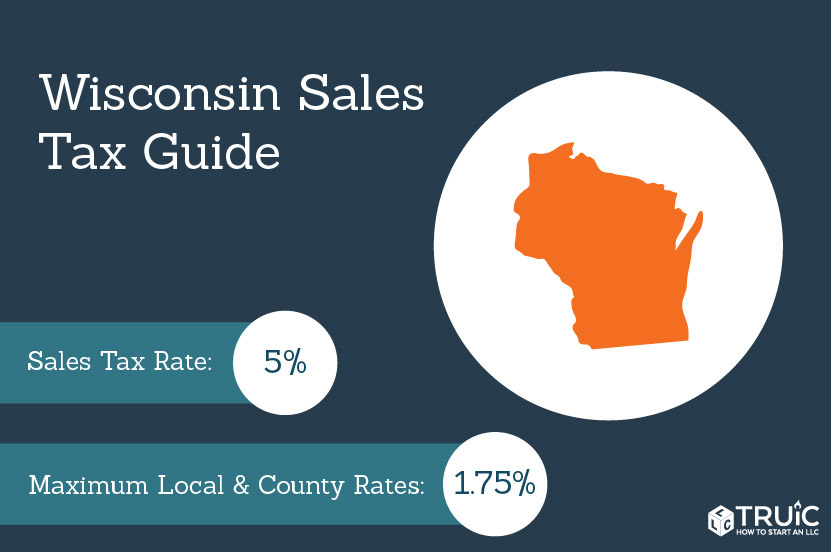

Wisconsin Sales Tax Small Business Guide Truic

Tax Prep Documents Checklist H R Block

Can A Subchapter S Corporation Use The Net Operating Loss Carryback Sapling

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How To Convert An Llc To An S Corp Truic

Calculate Your S Corporation Tax Savings Zenbusiness Inc

Tax Liability What It Is And How To Calculate It Bench Accounting

S Corp Tax Secrets Tax Savings Strategies 2023 White Coat Investor